Shared ownership costs

We know buying a home is a big step, and budgeting for it can feel overwhelming. We’ve broken it down to give you a clearer idea of what to expect.

How it all adds up

First things first... Let's understand where your money goes when buying a shared ownership home. The idea is that you buy a percentage of the home (based on your affordability), through cash or a mortgage, and you pay rent for the rest of the home you don't own.

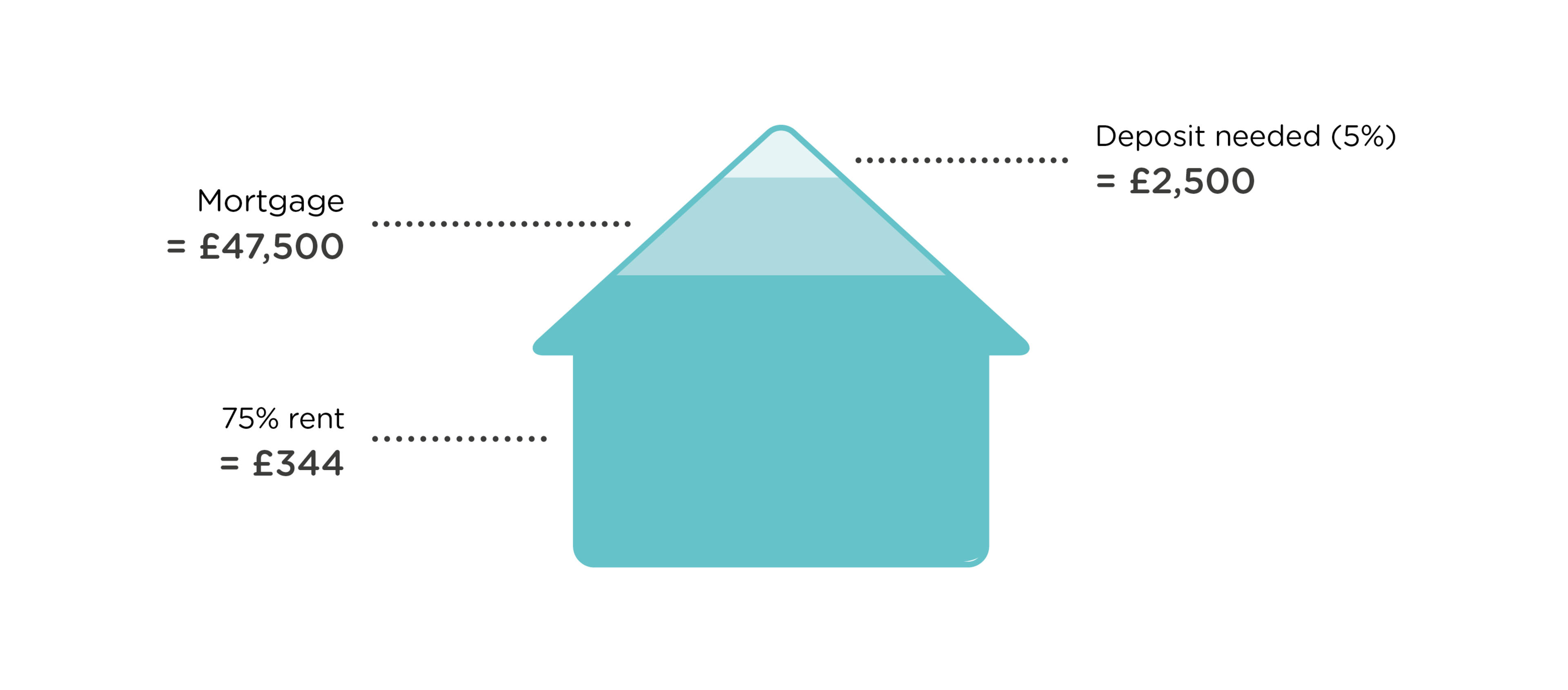

For example, you wish to buy a 25% share of a home worth the full market value of £200,000. You would:

Need a 5% deposit of £2,500.

Have a mortgage for £47,500. Your monthly mortgage repayments would be around £238 (based on a 5% interest rate over 25 years).

Pay subsidised rent on the other 75% of the home you do not own, for around £344 a month.

Total monthly cost:

Mortgage: £238 (based on 5% interest over 25 years)

Rent: £344

Total: £582 per month

*This total does not include your service charge or other monthly costs you will pay.

Typical costs when buying through shared ownership

These are other typical things you’ll pay for as you go through the process of buying a shared ownership home:

Reservation fee (£500, this is taken off your final purchase price)

Independent Financial Advisor (IFA) fee (£500 if applicable)

Mortgage valuation fee – to confirm your home’s value

Mortgage arrangement fee – sometimes charged by your lender

Documentation/engrossment fee (£180 - £200)- this is a fee we take when preparing the lease

Solicitor’s fees - this varies depending on your solicitor

Stamp duty – as a shared ownership buyer, you can choose to:

- Pay stamp duty on the full market value upfront, or

- Pay in stages as you buy more shares (only if you go over 80% ownership)

If you want to find out more about the stamp duty threshold, you can do so on the Gov.uk website.Apportionment of rent (rent to the end of the month, plus next month's rent in advance)

Apportionment of service charge (Service charge to the end of the month, plus next month's service charge in advance).

Ongoing costs

Once you’ve settled in, there are some regular costs to keep in mind:

Service charge – this covers buildings insurance, maintenance, repairs, cleaning of shared spaces, and sometimes a sinking fund for major future works

Management fee – this helps cover the cost of managing the development, often included in your service charge

Estate charge (if applicable) – for the upkeep of outdoor areas, private roads, or green spaces

Council tax - set by your local council for services like waste collection and street lighting. The amount depends on your property band and local rates. Check your council tax band on the Gov.uk website

Ongoing costs

Once you’ve settled in, there are some regular costs to keep in mind:

Service charge – this covers buildings insurance, maintenance, repairs, cleaning of shared spaces, and sometimes a sinking fund for major future works

Management fee – this helps cover the cost of managing the development, often included in your service charge

Estate charge (if applicable) – for the upkeep of outdoor areas, private roads, or green spaces

Council tax - set by your local council for services like waste collection and street lighting. The amount depends on your property band and local rates. Check your council tax band on the Gov.uk website

Understanding your service charge

Each year, we’ll give you a budgeted estimate for your upcoming service charge. At the end of the year, we balance the books:

If we spent less than expected, you may receive a refund

If we went slightly over, you might receive an invoice for your share (depending on your lease)

If you ever have questions or think something doesn’t look right, you have the right to challenge your service charge through the FirstTier Tribunal, a formal but fair way to resolve any housing-related disputes.

We know that costs and legal jargon can feel overwhelming. If you ever need anything explained more clearly, just get in touch. We’re here to help make your home-buying journey as smooth and exciting as possible.

There's more

Keen to find out more?

Whether you’d like to book a viewing or simply have a quick introductory chat, our helpful advisory team would love to hear from you.